Introduction

Real estate investing is a tried-and-true way to generate income . Real estate investors purchase, manage, and sell properties to create financial stability. This guide explores what it means to be a real estate investor, covering different types of real estate investments, ways to succeed, and potential challenges.

Types of Real Estate Investments

1. Residential Real Estate

- Single-Family Homes: Homes intended wholesale in real estate for individual families. These are preferred among first-time investors due to their lower cost and simplicity in management .

- Multi-Family Properties: Real estate that accommodates several families, like apartment buildings and multiplexes. They generate more rent but demand greater management effort.

- Vacation Rentals: Homes leased for short stays, typically via sites like Airbnb. These can bring in substantial earnings but may have higher vacancy rates and management needs .

2. Investing in Commercial Properties

- Office Buildings: Properties used for office rentals. They often have lengthy tenancy contracts, providing steady income .

- Retail Properties: Commercial spaces occupied by retail outlets. Success is linked to the success of the tenants .

- Industrial Properties: Industrial buildings such as factories and storage units. These have long leases and low management needs .

3. Industrial Real Estate

- Warehouses: Large storage spaces for goods and materials. Demand is increased by the rise in e-commerce.

- Manufacturing Facilities: Sites for the production and assembly of goods. These need expert understanding to invest .

- Distribution Centers: Hubs for logistics and transportation. High demand in supply chain management .

4. Investing in Land

- Undeveloped Land: Raw land without any development. It offers opportunities for building but can be risky .

- Developed Land: Property readied for building projects. Requires major capital and development skills.

- Agricultural Land: Farmland used for what is wholesaling in real estate growing crops or raising livestock. Offers long-term stability but requires farming expertise .

Real Estate Investment Strategies

1. Long-Term Holding Strategy

- Overview: Purchase properties to rent out and hold them for the long term to benefit from rental income and property appreciation.

- Pros: Regular income, tax incentives, and increased property value over time.

- Cons: Needs active management, locks in capital, subject to market fluctuations.

2. Fix and Flip

- Overview: Purchase undervalued homes, refurbish them, and sell for profit.

- Pros: Quick returns, enhanced property value.

- Cons: High risk, requires construction knowledge, market timing crucial.

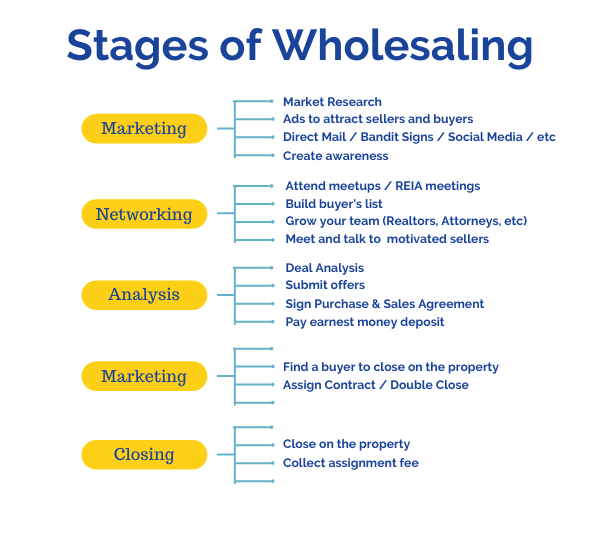

3. Property Wholesaling

- Overview: Discover discounted properties, put them under contract, and sell the contract.

- Pros: Low capital requirement, quick turnaround, minimal property management.

- Cons: Needs to find sellers and buyers, lower profit margins.

4. REITs (Real Estate Investment Trusts)

- Overview: Invest in a company that owns and operates income-producing real estate. REITs are traded on stock exchanges.

- Pros: Easy to sell, diversified holdings, passive returns, expert management.

- Cons: Market volatility, less control, fees and expenses.

5. Real Estate Crowdfunding

- Overview: Pool money with other investors to fund real estate projects. Platforms like Fundrise and RealtyMogul facilitate this.

- Pros: Affordable entry, diverse investments, involvement in significant projects.

- Cons: Limited control, platform fees, investment risk.

Steps to Becoming a Real Estate Investor

Education and Research:

Learn the Basics: Familiarize yourself with real estate dynamics, funding options, management, and strategies.

Networking: Join investor groups, go to real estate seminars, and make connections with other investors.

Set Investment Goals:

Define Objectives: Clarify your investment aims, focusing on income

Set Investment Goals

- Define Objectives: Determine your investment goals, such as income generation, capital appreciation, or portfolio diversification.

- Risk Tolerance: Understand your risk comfort level and pick strategies that match.

Develop a Business Plan

- Market Analysis: Analyze markets, property categories, and expected returns.

- Financing Strategy: Outline your funding strategy, considering mortgages, loans, and savings.

Build a Team

- Key Professionals: Gather a team of agents, lawyers, accountants, managers, and contractors.

- Networking: Continue building relationships with professionals who can assist you.

Start Small

- Initial Investment: Start with modest investments or basic projects for learning.

- Learn and Adapt: Adapt your approach based on lessons from initial investments.

Scale Up

- Growth: Expand your investments as your experience and confidence grow.

- Diversification: Diversify by adding different properties and locations to your portfolio.

Challenges and Risks in Real Estate Investing | Potential Challenges and Risks

1. Market Volatility

- Economic Factors: Economic shifts, interest rates, and policies can affect real estate markets.

- Mitigation: Keep up with market trends and adapt your strategies.

2. Property Management

- Tenant Issues: Dealing with tenant complaints, vacancies, and rent collection can be challenging.

- Solutions: Consider hiring a management company or enhancing your management skills.

3. Financing and Cash Flow

- Funding Challenges: Securing financing and maintaining positive cash flow can be difficult.

- Strategies: Plan your financing well and maintain an emergency reserve fund.

4. Legal and Regulatory Issues

- Compliance: Make sure your investments adhere to legal requirements.

- Advice: Seek legal advice to navigate and comply with regulations.

Final Thoughts

Real estate investing can be highly rewarding to grow wealth and meet financial objectives. By understanding different types of investments , setting clear goals , and being prepared for challenges , you can navigate the world of real estate investing successfully . Whether you are a beginner or an experienced investor , ongoing education and flexibility are key to achieving long-term success .